In November 2025, the German electric vehicle (EV) market witnessed a complex landscape for Chinese automotive brands, marked by varying performance and significant import tariffs.

Market Overview

- Total new passenger vehicle registrations: 244,544 (0.5% decline year-over-year)

- Battery electric vehicle (BEV) market: 35,167 units (21.8% decrease)

- Plug-in hybrid vehicles (PHEV): 20,604 units (13.7% increase)

- Chinese EV brands: 2,710 BEVs (8% market share)

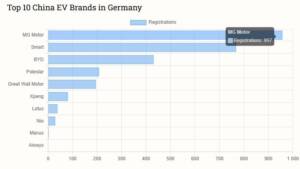

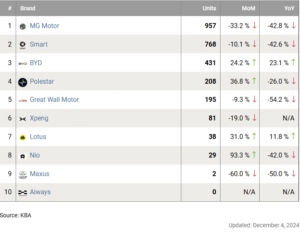

Chinese Brand Performance

Top Performers

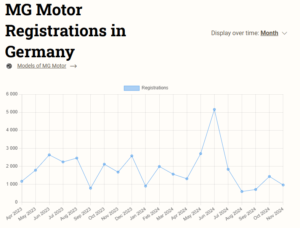

- MG (SAIC): 957 EVs

- 33.2% decline month-on-month

- 42.8% drop year-over-year

- Facing 45.3% total import tariffs

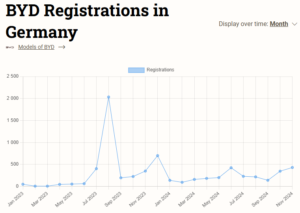

- BYD: 431 vehicles

- 24.2% increase month-on-month

- 23.1% growth year-over-year

- Subject to 27% import tariffs

Mixed Results

- Xpeng: 81 vehicles (19% monthly decline)

- Nio: 29 vehicles (93.3% monthly increase, but 42% yearly decline)

- Great Wall Motor/Ora: 195 vehicles (9.3% monthly drop)

Comparative Context

- Tesla: 2,208 EVs in November (55% decrease from last year)

- European Commission increased tariffs on Chinese-made EVs to 45.3% from October 30th

Key Insights

The German EV market demonstrates the challenges Chinese manufacturers face, including:

- High import tariffs

- Fluctuating market demand

- Increasing competition

- Geopolitical trade tensions

The data suggests a volatile environment for Chinese EV brands in the European market, with performance varying significantly across different manufacturers.